Build A Info About How To Apply For A Gst Number In Canada

Do you have to register for gst/hst number?

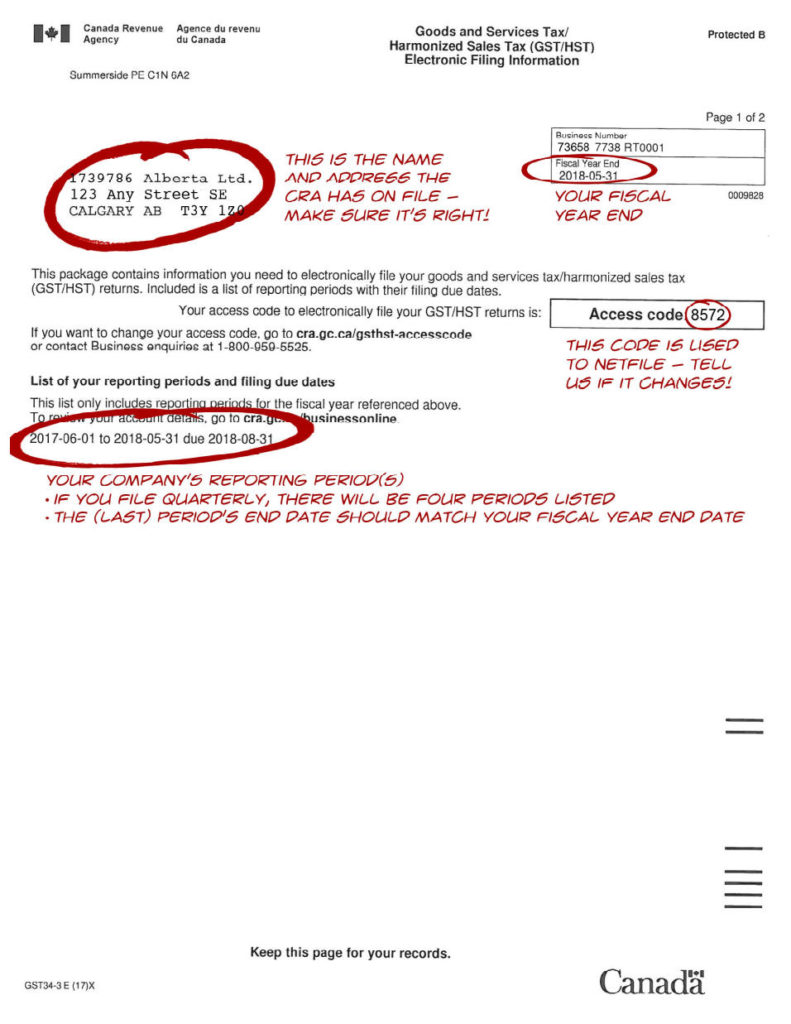

How to apply for a gst number in canada. Voluntary gst/hst registration if you are a small supplier. A gst/hst account number is part of a business number (bn). You can do this in one of the following ways:

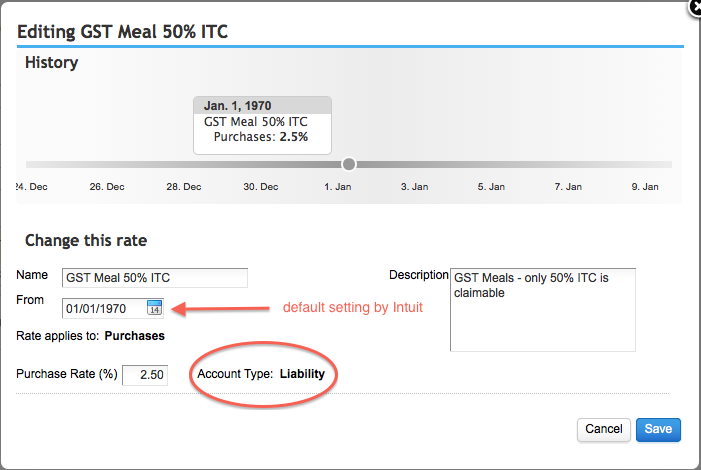

4 important things you must know before getting gst/hst number. How the gst number works. For example, you can register by phone for a business number or cra accounts (gst,.

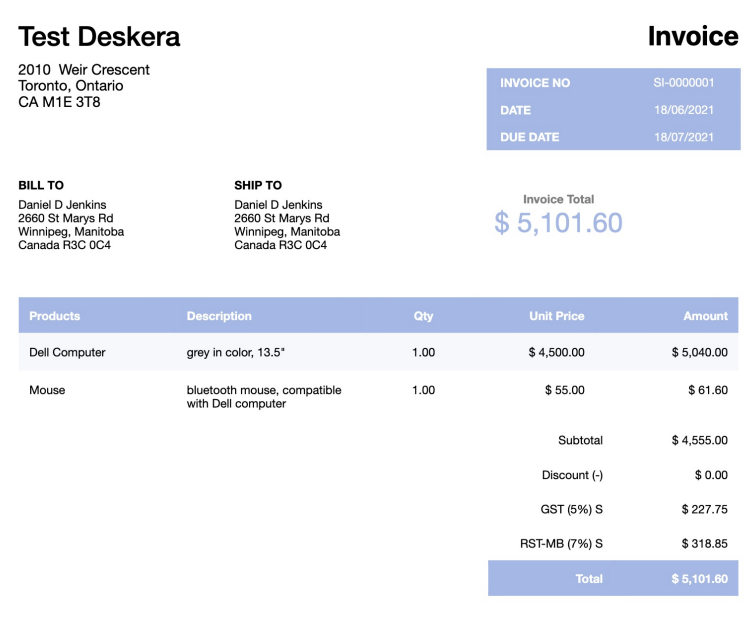

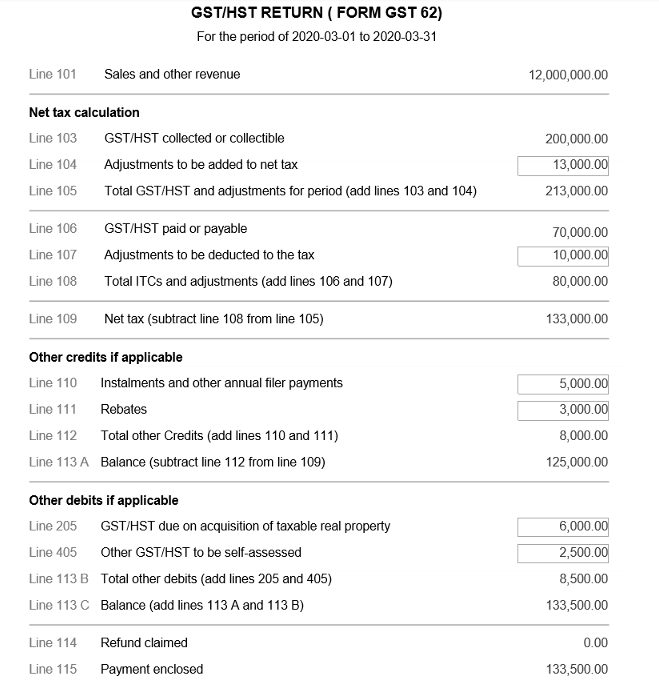

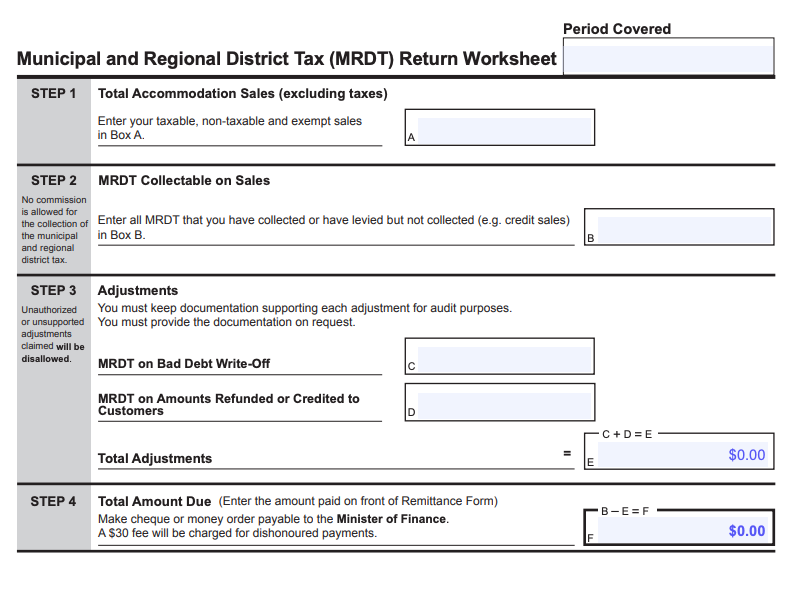

Fill out a gst/hst return each tax. If you want to register for gst through an online method, you can do so by phone. Basically, for gst/hst registration, you apply to the cra for a gst/hst number.

Register for a gst/hst account. The process is incredibly convenient, as there are three different ways to. The provinces of new brunswick, newfoundland and labrador, nova scotia, and prince edward island all tax 15%, while ontario charges 13%.

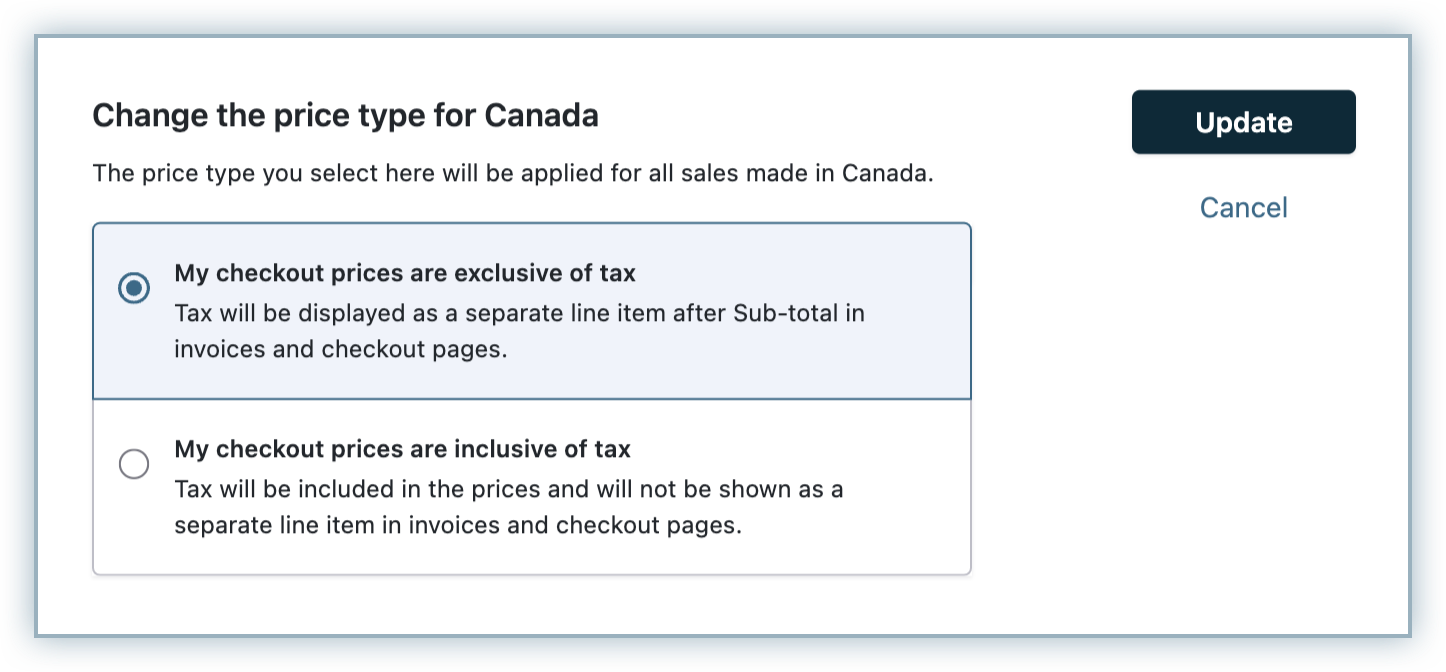

The process is incredibly convenient, as there are three different. You have two options when registering for gst/hst number: To get your business’s gst number, simply contact the canada revenue agency to begin the application process.

Gst numbers may seem intimidating but the entire process is both logical and simple. Specifically, you must register for the gst and the qst if your total worldwide taxable supplies. As a rule, you must register for the gst and qst if you carry on commercial activities in québec.